Author Archives: jasperx

Revised GOMO Bankruptcy Plan

Revised Bankruptcy Plan:

GOMO has revised its plan which will be the basis for its starting point in a joint negotiation with the Creditor Committee or possibly a separate plan to be resubmitted and voted upon by the neighborhood. These are general principles and subject to revision after potential negotiations with the Creditor Committee.

- A flat, simple Transfer fee of $1500.

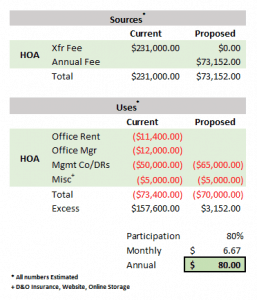

This will be assessed on future, and not current, property owners and will include a reasonable adjustment mechanism so it may be lowered or raised based on future needs of the neighborhood. Discontinue the current 0.75% assessment of sold property metric which is the basis of the current transfer fee. Abandon the prior contemplated $80 annual fee proposal. Current property owners will not pay any fees. The judge was adamant that GOMO include a mandatory annual fee in its earlier plan. However, with the voting results in hand, we are comfortable standing up to the judge and recommending a transfer fee on future property owners be maintained, but significantly lowered, and improve the method so as to address the concerns of residents regarding ability to adjust in the future.

- Maximize money returned to Creditors.

After attorney’s fees are paid, post-petition fees returned, and 1 year reserve of operating expenses for future HOA are set aside,100% of remaining funds will be returned to creditors. It is our objective to ensure our plan maximizes the funds returned to creditors.

- Updated Deed Restrictions and Bylaws.

Neighbors, we need these updates. Some of the current restrictions are untenable and must be revised/updated. On this point there is very little disagreement. There must be a reasonable amendment process, sorely lacking in the current DRs, to allow the DRs to evolve moving forward. Had a workable and reasonable amendment mechanism been in place, the neighborhood could have easily voted years ago whether it wanted to amend or remove certain restrictions that weren’t equitably established and enforced through all sections of GO. The existing method requiring an affirmative vote of 67% of all neighbors is too high a threshold and a difficult task which is why the DRs have not been updated. The GOMO Board strongly advocates capitalizing on this opportunity to update and revise our DRs and bylaws under the protection of and as part of the bankruptcy case to more easily ensure and facilitate a timely passage.

- Fix GOMO Formation Defect.

- GOMO leadership resigns upon plan confirmation.

The new HOA Board elected after bankruptcy is completed will consider the benefits of 3rdparty professional management for Deed Restriction enforcement. It is the GOMO Board’s belief that ensuring a professional, objective process for DR enforcement would allow the neighborhood to move forward with greater confidence, but feedback at prior Townhalls and the voting results suggest this is not the most pressing priority for the neighborhood.

May 7, 2019 Lauren Simpson on St. Julian’s Wildlife Habitat

Brief description. The average neighborhood yard looks pretty, but doesn’t support the wide range of wildlife that is crucial to a healthy environment and community. The good news is that yards can be both beautiful and beneficial by incorporating the native plants that support our local wildlife! In this presentation, Ms. Lauren Simpson will share a few handy tips on how to create a wildlife garden at your own home, for the enjoyment of your family and the benefit of your community. She will also bring native wildflower seeds from her own wildlife-habitat garden to share with attendees. Come join us to learn how to transform your own yard into a beautiful wildlife paradise!

Bio. Since early 2015, Lauren Simpson has spent her spare time transforming her Houston home gardens into a pollinator-friendly habitat, currently a Certified Wildlife Habitat (National Wildlife Federation), a Monarch Waystation (Monarch Watch, Waystation No. 10925), and a Certified Butterfly Garden (North American Butterfly Association). She promotes pollinator conservation and wildscaping through state and local presentations, local events, and an educational Facebook community entitled “St. Julian’s Crossing-wildlife habitat” – the name adopted for her family’s Monarch Waystation. Ms. Simpson is a member of the Native Plant Society of Texas (NPSOT) and Butterfly Enthusiasts of Southeast Texas, and she actively volunteers in her neighborhood gardening group, the Oak Forest Community of Gardeners. She has also received the Level 1 certification through the NPSOT Native Landscape Certification Program (NLCP) and serves on the NPSOT subcommittee for NLCP Level 4.

Ms. Simpson is a Clinical Assistant Professor at the University of Houston Law Center, where she teaches Lawyering Skills and Strategies. She earned her B.A. (cum laude) in French and International Studies at Washington University in St. Louis, Missouri in 1988. She obtained her J.D. (cum laude) from the University of Houston Law Center in 1994. She is a spring 2016 recipient of the University of Houston Teaching Excellence Award (Instructor/Clinical category) and the spring 2017 and spring 2018 Professor of the Year for Law Center faculty teaching in the part-time program.

April 2, 2019 Doug Waldrep on Bike Houston

BikeHouston’s mission is to create a dynamic city that is safe and comfortable for all people on bikes. We do this by partnering with the the city and other organizations to expand mileage and access to high quality bikeways and sidewalks, to educate all road users, and to enhance the enforcement of laws that save lives.

BikeHouston’s current focus is the implementation of the Houston Bike Plan. Houston’s first comprehensive plan for a bike network in twenty years. For more information visit us at http://www.bikehouston.org.

March 5, 2019 Tonya Knauth on Estate Planning, Wills, Other Documents

Are your ducks in a row? Do you have questions about estate planning: wills, trusts, or guardianship? Come to the February 5, 2019 Civic Club meeting! Tonya Knauth, community member, Civic Club VP and estate planning/probate attorney, will speak on these topics. She will provide information about how to best prepare for possible incapacity and death, and answer general questions. The presentation will be broad and applicable to everyone – younger, older, married, single, with kids or without. Tonya’s objective is to provide information and dispel misinformation, giving her audience more ease and knowledge about these subjects.

Website: www.tonyaknauth.com

FB: Tonya L. Knauth, Attorney PLLC

Feb. 5, GOCC Meeting Speaker Trey Holm on Identity Theft

DATE:February 5, 2019

TIME:7:05 — 7:45 pm

LOCATION:Garden Oaks Montessori Magnet

901 Sue Barnett Drive

Houston, Texas 77018

TOPIC:Identity Theft

Trey Holm, Supervising Attorney for Houston Volunteer Lawyers, will speak on Identity Theft this Tuesday February 5th at the Garden Oaks Civic Club meeting – 7 PM GOMM Cafeteria. The presentation will cover its definition, what areas of our personal information is vulnerable, ideas to protect oneself against an attack, and what to do when one’s identity is stolen.

Proposed Deed Restriction & Bylaws

Bankruptcy Status Conference Oct. 25, 2018

A status conference in the GOMO bankruptcy proceeding was held by Judge David Jones Thursday afternoon, October 25, 2018. Counsel for GOMO, the Creditor Committee and the United States Trustee were present.

- GOMO counsel Johnie Patterson reviewed the actions that had taken place since the last appearance before the Court in August, including publication of the results of the GO Reform committee survey results, the holding of two town hall meetings, and multiple additional meetings between GOMO Board members and the Creditor Committee members.

- Mr. Patterson also outlined the position of GOMO regarding the way forward, and noted the areas where the Creditor Committee disagreed. Mr. Rubio, counsel for the Creditor Committee, restated the position of the Creditor Committee from his perspective.

- Mr. Patterson set out the general approach that GOMO sees for the conclusion of the bankruptcy proceeding, including presentation of a plan of reorganization that results in a order from the court effectively curing the formation defect present in GOMO, and representing that certain bylaw and deed restriction changes would be pursued after the plan is confirmed. Combination with Garden Oaks Civic Club may be part of the plan.

- Judge Jones rendered several times his disapproval of the concept of transfer fee funding of homeowner association activities.

- Collection of Transfer Fees remains on hold through December 20, 2018.

- The Court also permitted resident comments, and heard statements from two residents.

- The Court determined that GOMO should prepare and present a disclosure statement and plan by December 20. While the plan was not required to be a joint plan, he asked GOMO counsel to keep Creditor Committee counsel informed as the plan is prepared, and to consider his input, which Mr. Patterson indicated he would do.

- The two counsel were charged with drawing up an appropriate order reflecting the results of this hearing and presenting it to the judge.

- The pending GOMO motion to remove several Creditor Committee members was held in abeyance until the December hearing, unless counsel for the United States Trustee advises the Court and the parties otherwise.